Benefits of MSWIPE Platform

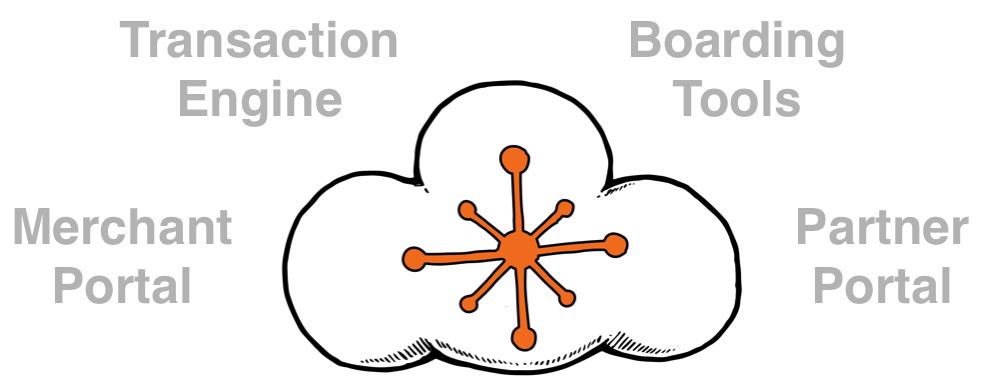

Our cloud-based platform ensures control over the entire transaction cycle by enabling comprehensive gateway connectivity, reporting, and administrative functions. Secure partner and merchant portals deliver valuable insights into all payment activity.

- Single Point of Integration - Access multiple acquirers in the US, Canada, Latin America & Europe

- Merchant Control - Merchants selects payment types & processing endpoints and can easily change without enduring recertification process

- Simplifies PCI Compliance - No actual data is stored within the merchant environment*

- Simplifies Transaction & Batch Management - Provides a consolidated view of all payment activity

Multi-Point Processing

Seamlessly enables multi-point processing and robust e-commerce and m-commerce capabilities

- Supports Visa Accelerated Connection Platform (VACP) and First Data Rapid Connect

- PCI 3.0, EMV and NFC certified

- Supports all major card brands

- Virtual terminal supports MO/TO processing

- Multi-currency, cross-border and dynamic currency conversion

- Interfaces with many major shopping cart providers

- Certified to major processors in U.S., Canada, Latin America, and Europe

Administrative & Reporting Features

Robust administrative and reporting features provide businesses with the tools and resources necessary to manage all payment activity.

- Merchant and Partner portals are configurable at multiple levels

- Set hierarchy and user-access rules

- Dashboard reports provide snapshot into activity

- Detailed reports at location, enterprise and portfolio level

- Advanced filters quickly locate transactions

- Text and Email alerts provide instant updates